The GBI Platform is the trusted backbone for investing in gold, silver, and other physical precious metals.

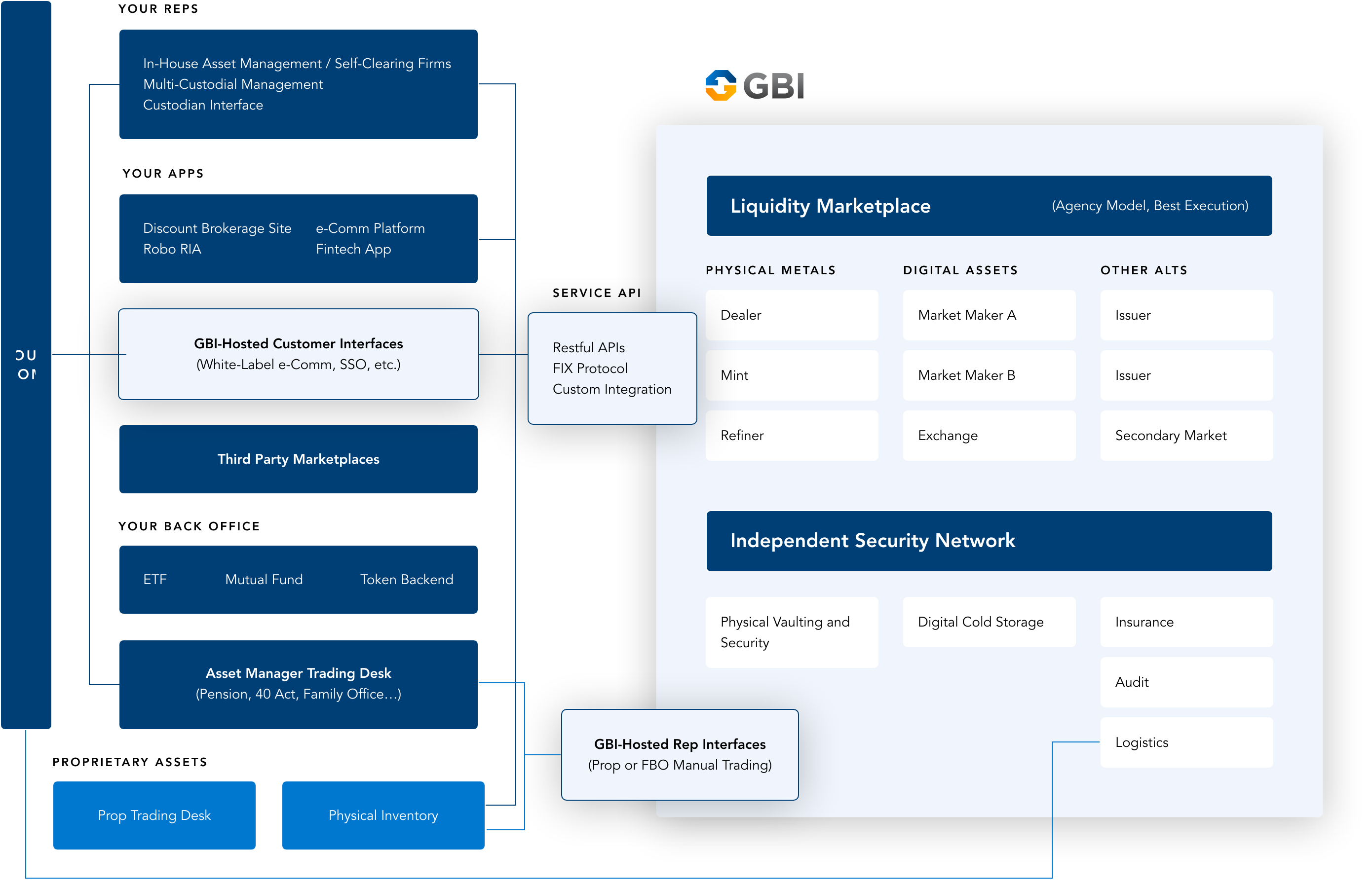

It integrates wealth managers, online metals dealers, high-net-worth investors, corporate treasurers, and fintechs into a competitive global marketplace with real-time trading and secure custody, while providing deep liquidity and transparent accountability.

With GBI, physical precious metals benefit from the same modern infrastructure and seamless access long established for stocks and bonds.

Institutional Customers

Physical Storage Vaults

Metals Providers (Dealers/Refiners)

Assets Under Administration

Trading Volume

Customer Accounts