Empower your wealth management strategy with GBI’s cutting-edge platform, designed to seamlessly integrate physical gold into your trading system and investment alternatives. Attract discerning investors seeking to diversify their portfolios and enhance resilience against market volatility.

Enhance your investment offerings and cement client relationships with physical precious metals provided by GBI. Our platform caters to financially sophisticated clients seeking diversified investment options, helping your firm attract new clients and generate additional revenue through transactional and asset management fees.

Transform the way you incorporate physical precious metals into client portfolios. GBI offers a turnkey solution, seamlessly compatible with traditional systems, enabling true diversification that can significantly enhance risk adjusted portfolio performance.

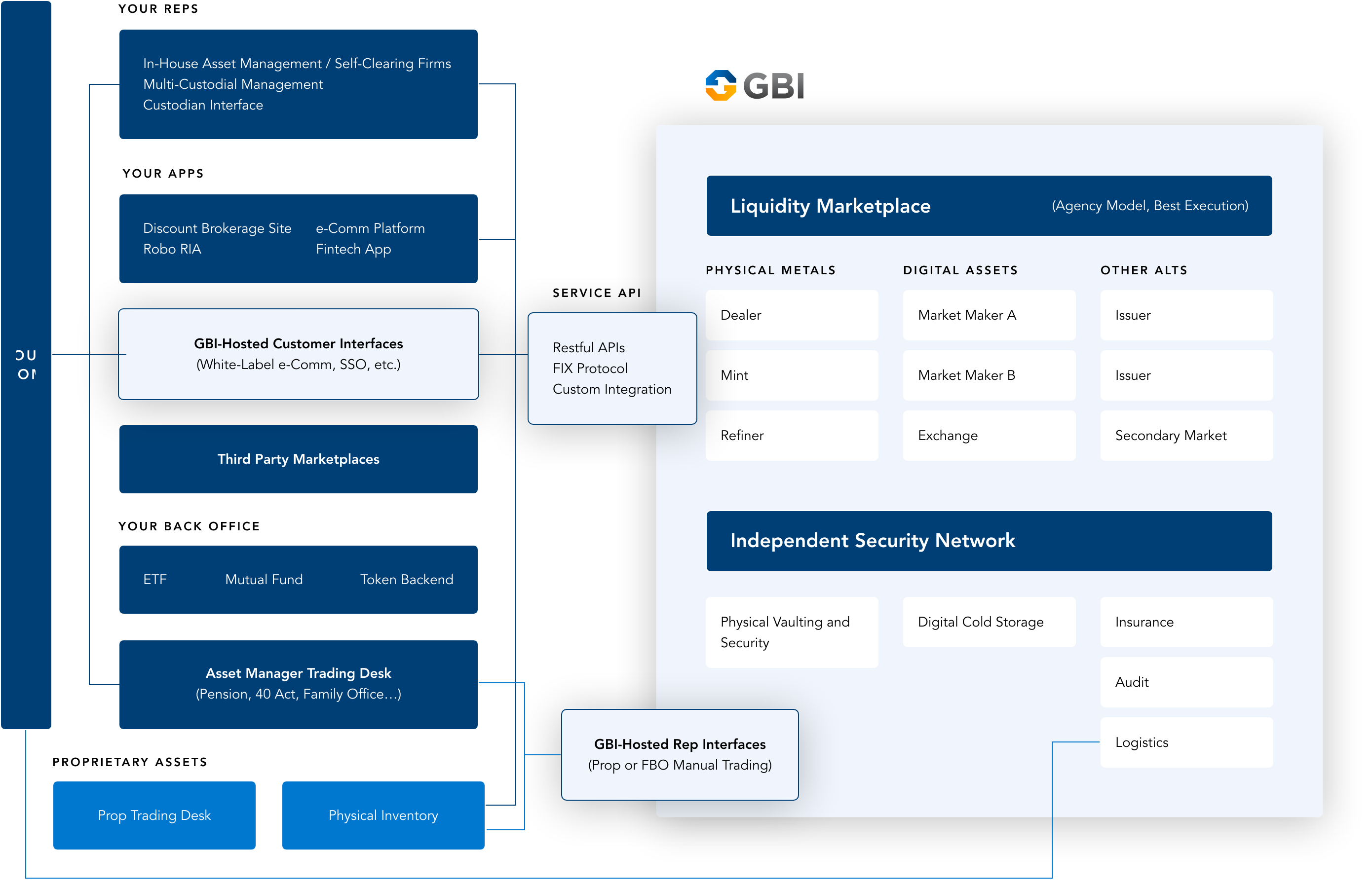

Our team has decades of experience in the heavily regulated investment industry and apply the same rigorous standards to physical precious metals. This includes providing agency-model liquidity, ensuring secure and independently audited storage, and maintaining the highest operational standards—far beyond what typical precious metals providers offer.

Our dedicated sales team is committed to supporting wealth advisors as they tend to their underlying clients. This includes insightful research, recommended allocations and other comprehensive support designed to enhance both the advisor and client experience.