RIAs need a compelling investment offering that attracts new clients and prevents them from “trading away”.

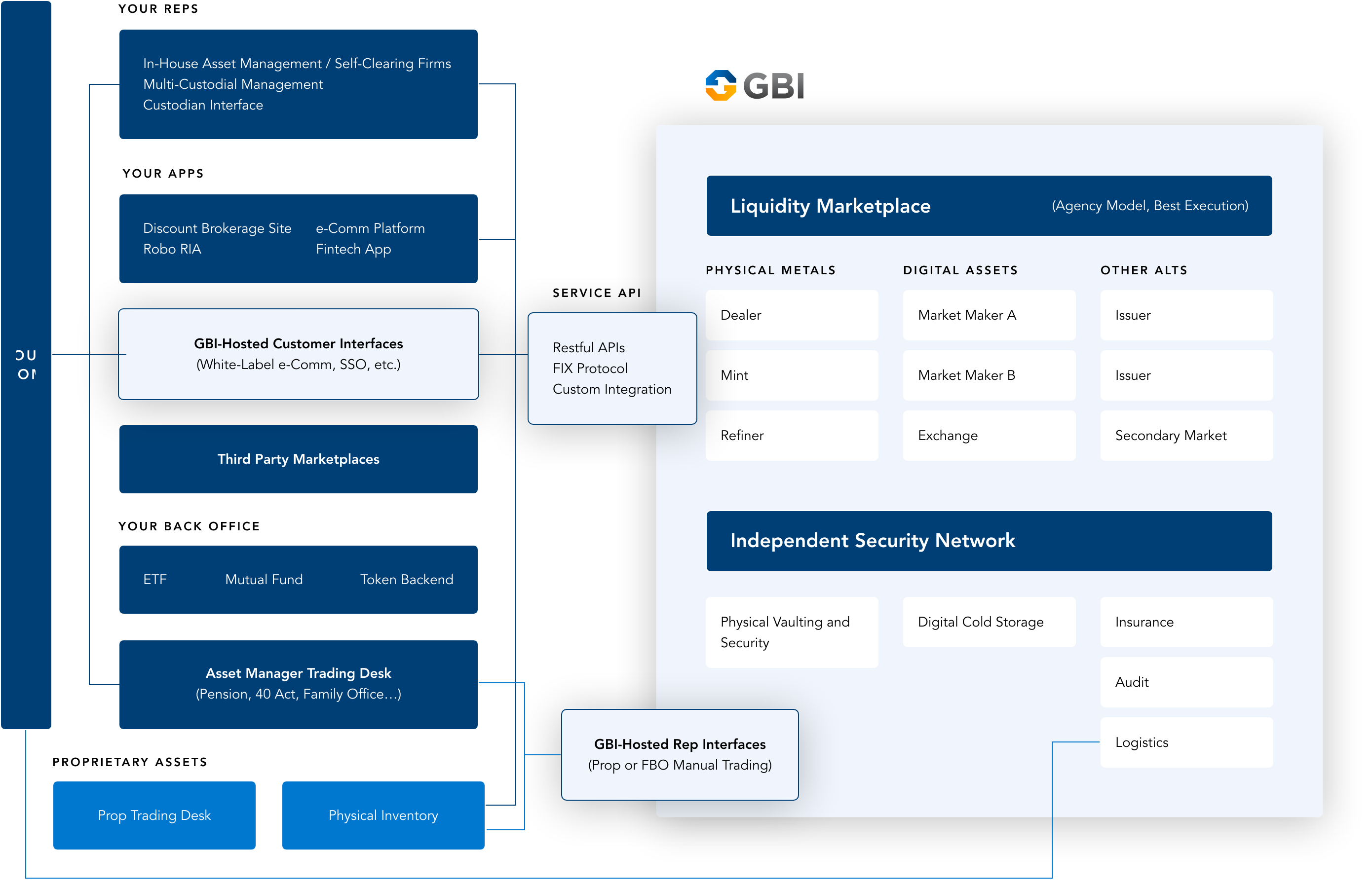

GBI enables the integration of physical precious metals into a client investment account while being treated “above the line” for AUM.

Most of the world’s leading wealth managers offer a physical precious metals program to their clients. With GBI, your clients can have all of the capabilities of a bullion bank, owning actual gold and silver coins and bars, which are securely stored and insured in world-class vaults and available for delivery upon request.

With GBI, your clients gain direct ownership of physical precious metals, offering them complete control over their investments. These assets are stored FBO (For the Benefit of) your clients in top-tier vaulting and custodial facilities, ensuring competitive pricing and fast execution through connections to deep liquidity markets, and home delivery.

Inasmuch as many major wealth management firms have a physical precious metals program (often administered by GBI), they expect to have access to that program at independent shops. This allows them to move existing assets as well as serve their preferred portfolio model.

Our dedicated sales team is committed to supporting wealth advisors as they tend to their underlying clients. This includes insightful research, recommended allocations and other comprehensive support designed to enhance both the advisor and client experience.